FOR Communication 14/2023: National Political Bank - guarding the party rather than the currency

According to the constitution, the National Bank of Poland is responsible for the value of the Polish currency, and according to the law, its primary objective is to maintain a stable price level.

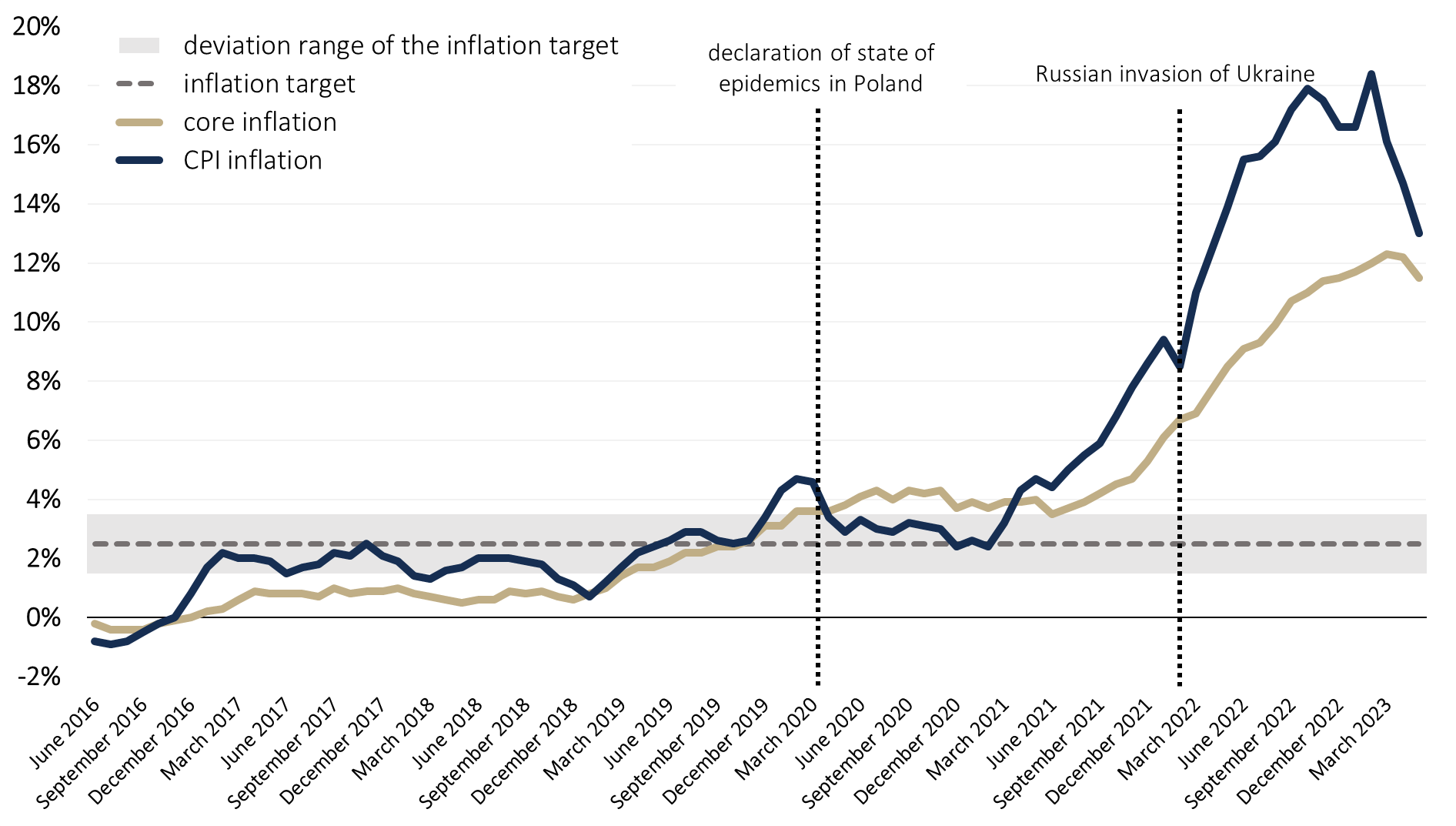

However, during Adam Glapiński's presidency (since June 2016), the accumulated inflation until May 2023 reached 47.6%, which means an average increase of the price level of about 5.7% per annum, while the inflation target is 2.5% with a deviation range of ±1 percentage point. In February this year, inflation reached 18.4% y/y, marking the highest rate in over 26 years.

In response to numerous criticisms, the National Bank of Poland (NBP) has launched an "informational" campaign under the catchphrase "blaming the NBP and the government for high inflation is the Kremlin's narrative." In this campaign, the NBP points out that the main causes of inflation are not populist decisions of the government and loose monetary policy of the central bank, which facilitated cheap borrowing for the state. Instead, the NBP attributes the high inflation to the Russian aggression on Ukraine and the pandemic and its effects. This campaign represents another example of the NBP's political involvement and unlawful use of state resources for election purposes.

Contrary to the NBP's campaign claims, inflation had exceeded the upper deviation from the target even before the COVID-19 pandemic, reaching over 4% in the first three months of 2020. After the outbreak of the pandemic, inflation in Poland temporarily decreased to around 2.5% at the turn of 2020 and 2021, thanks to a declining energy prices on the global markets. However, throughout this period, core inflation, excluding food and energy prices, remained elevated.

Despite numerous alarming signals, the President of the NBP continued to state during press conferences that high and constantly rising inflation was transient, and any potential increases in the reference rate would be a "rookie mistake." The Monetary Policy Council did not opt for raising the reference rate until October 2021, when inflation reached 6.8%.2

Moreover, the NBP's Inflation Report published in July 2022 contradicted the notion that the pandemic and its effects were one of the main causes of high inflation. In the report, it was stated that "CPI inflation in December 2021 was 8.6%, of which a maximum of 3.8 percentage points can be attributed to disruptions in supply nets"3 caused by interruptions in supply chains due to governments’ measures to combat the pandemic. This implies that disruptions in supply chains accounted for just over half of the inflation in December 2021, and even without these disruptions, inflation would still be almost twice the target.

The aggression on Ukraine led by Putin’s Russia contributed to inflation (due to the rise in energy and food prices). However, it cannot fully explain the inflation reaching almost 10% at the beginning of 2022.

Chart. Inflation y/y under the presidency of Adam Glapiński

Source: FOR’s own study based on NBP data.

The full content of the publication can be found in the file to download below.

Contact to authors:

Marcin Zieliński, FOR board member & chief economist

[email protected]

Zofia Kościk, FOR junior economic analyst

[email protected]

Files to download